PARKSVILLE -- The Top Spot Diner in Parksville has been closed due to COVID-19 and may never reopen because of a minor loophole in the Canada Emergency Business Assistance (CEBA) program.

Peter LaPortee, the owner of the diner, says he meets all the requirements for CEBA but is ineligible because he uses a personal bank account and not a commercial one.

He’s reached out to several banks as well as the Canada Revenue Agency to try to access the $40,000 interest-free loan but has gotten no results.

“I’ve already lost $75,000 up until now and I can’t apply for anything because of the loopholes I don’t conform to,” said LaPortee.

LaPortee had to close his restaurant in March and layoff his six employees due to the pandemic.

“I’m kind of getting backed into a corner. I’ve worked on this business and sold both my houses to buy this business,” he said.

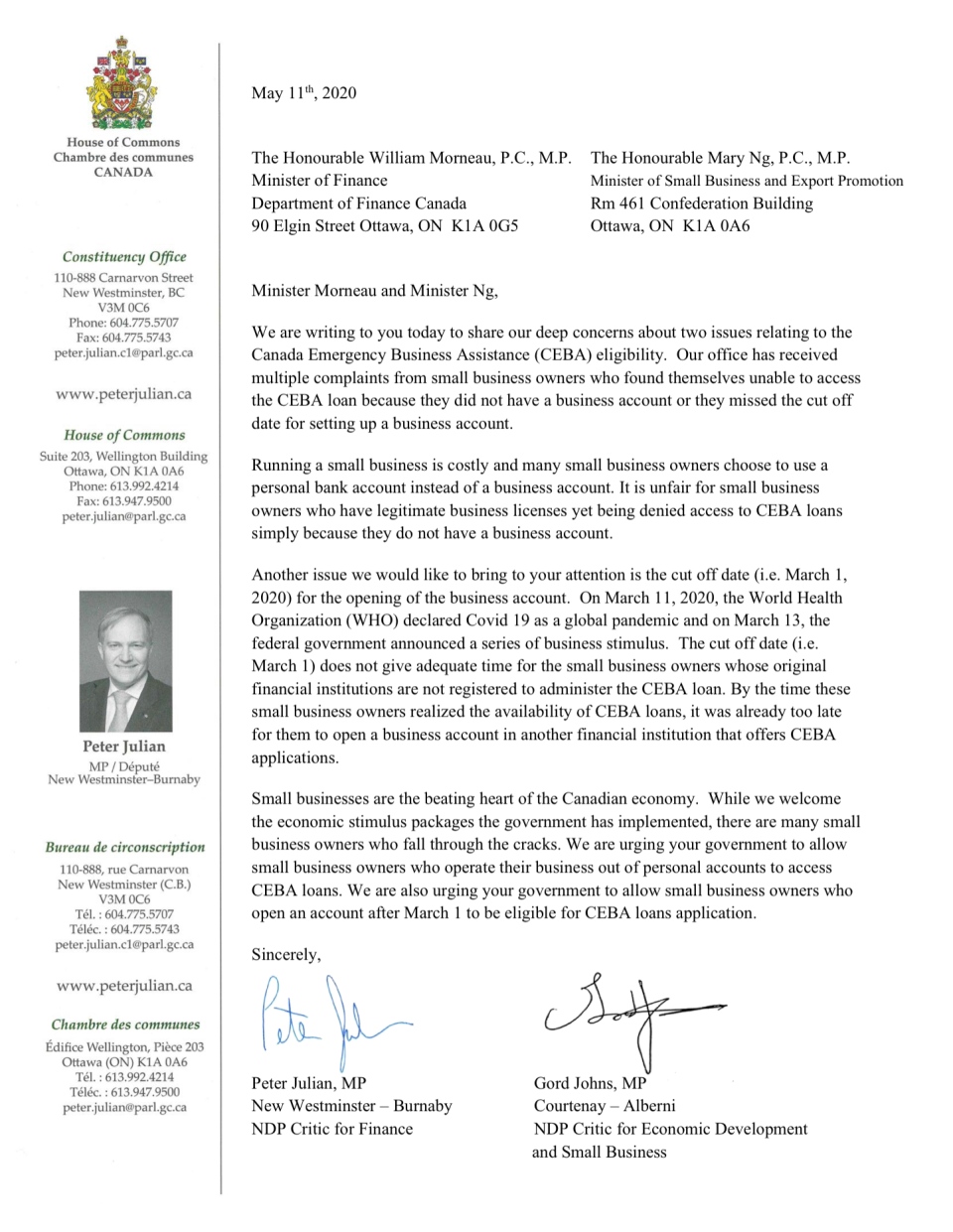

NDP MP and Critic for Economic Development and Small Business, Gord Johns, along with the NDP MP and Critic for Finance, Peter Julian, recently penned a letter to the Liberal government addressing their concerns with CEBA.

Both have fielded several complaints made by small business owners who are unable to access the funding.

“My phone is literally ringing off the hook,” said Courtenay-Alberni MP Gord Johns.

“This is a very small technical eligibility requirement the government could amend right now so that Peter and Top Spot Diner and businesses like them can get the help they need,” he said.

LaPortee fears he may go bankrupt if this technicality doesn’t get resolved quickly.

The letter penned by Johns and Julian can be found below: