B.C.‘s highest court has dismissed an appeal from the buyers of a Burnaby apartment building who were charged $6 million under the province’s foreign buyers tax regime despite being permanent residents of Canada.

In a decision issued last week, the B.C. Court of Appeal upheld a lower-court ruling that found the tax had been properly applied against the companies involved in the 2018 purchase, which were subsidiaries of a company wholly owned by a different company that was incorporated in China.

As they had during their case in the B.C. Supreme Court, Mailin Chen and Yongjin Yong argued before the Court of Appeal that their status as permanent residents of Canada and co-owners of the Chinese company should have made them exempt from the tax.

Writing for the three-judge appeal panel, Justice Harvey M. Groberman rejected this argument and agreed with the lower court’s reasoning in the case.

Complex ownership structure

Permanent residents of Canada are typically exempt from paying B.C.‘s foreign buyers tax, which was first introduced for Metro Vancouver properties in 2016 and has since been expanded to other areas of the province.

When Yong and Chen purchased a 38-unit apartment building on Burnaby’s Wilson Avenue for $30 million in 2018, they did so using multiple holding companies.

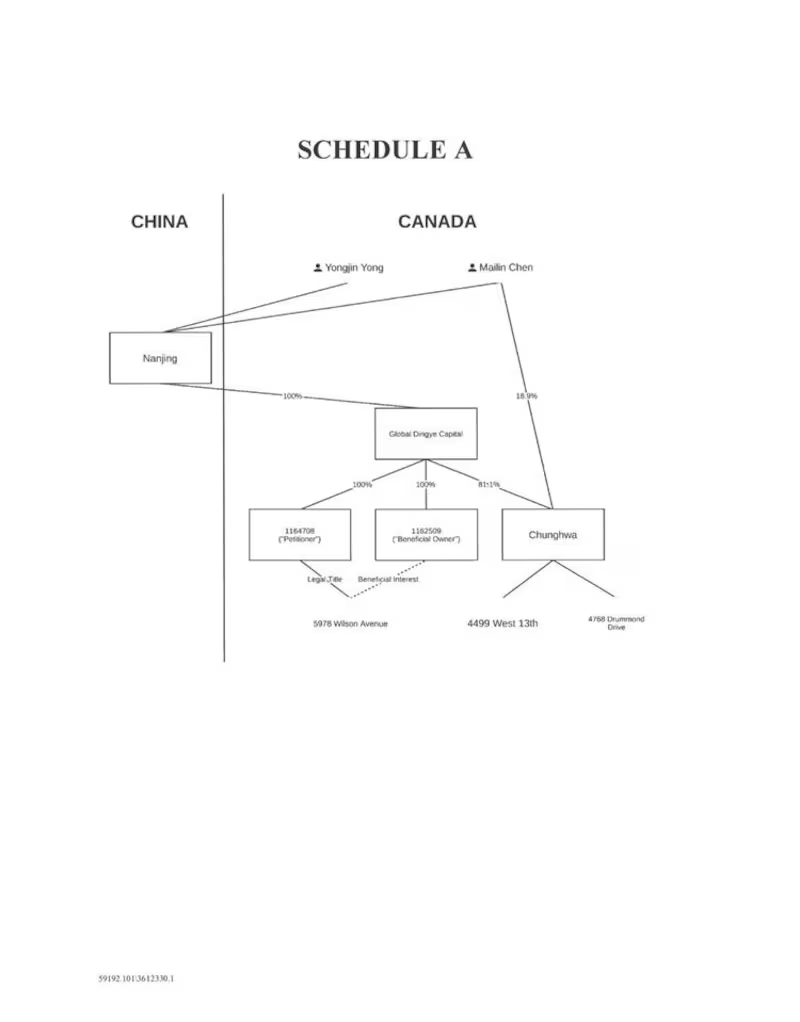

The 2023 B.C. Supreme Court decision outlines the ownership structure in a diagram and provides a more detailed summary of the situation than the B.C. Court of Appeal decision.

According to the lower court, Chen owns the majority of shares in a company called Nanjing Dingye Investment Real Estate Group Co. Ltd., which is incorporated in China. Yong holds the remainder of the shares in that company.

Nanjing is the sole shareholder of a B.C. company called Global Dingye Capital Ltd. That company, in turn, is the sole shareholder of two numbered B.C. companies involved in the purchase of 5978 Wilson Ave.

One of the numbered companies, 1164708 B.C. Ltd., purchased the building and holds it in trust for the other, 1162509 B.C. Ltd., which is referred to in court documents as the “beneficial owner” of the property.

The purchasing company brought the initial case to court and filed the appeal.

Grounds for appeal

In the appeal, Chen and Yong argued that the lower court judge had placed insufficient weight on the context and purpose of the foreign buyers tax legislation.

“The legislation was intended to discourage ‘foreign nationals’ from increasing housing prices by buying B.C. real estate,” reads Groberman’s decision, quoting from the petitioner’s submissions.

“The legislation was not intended, through levying additional (property transfer tax), to discourage the purchase of B.C. real estate by Canadian citizens, permanent residents of Canada, and Canadian-controlled corporations.”

Groberman was unconvinced by this assertion.

“The express purpose of the legislation is to reduce pressure on the local housing market by discouraging foreign investment,” the judge’s decision reads.

“It is not at all clear that investment by foreign corporations, even if controlled by Canadian citizens or permanent residents, falls outside of this purpose, particularly where it is difficult or impossible to obtain information on the corporations’ operations. I see nothing in the statutory purpose that precludes applying the (tax) to such corporations.”

While Chen and Yong argued that the provincial Ministry of Finance and the B.C. Supreme Court had interpreted the legislation too strictly and failed to consider its intent, Groberman found that both the intention of the legislation and its literal meaning supported the conclusion that their companies were foreign buyers and therefore subject to the tax.

“In my view, the interpretation reached by the ministry and by the chambers judge are the best fit for the language of the statutory provisions, and for the statutory, historical and social context,” the decision reads.

“Nothing in the petitioner’s arguments convinces me that their interpretations are inimical to the purpose of the legislation.”