Confusing, cumbersome, even offensive, that's just some of what critics are calling the NDP government's enforcement of its speculation tax.

As opponents sound off across the province, Langford's mayor is taking it a step further.

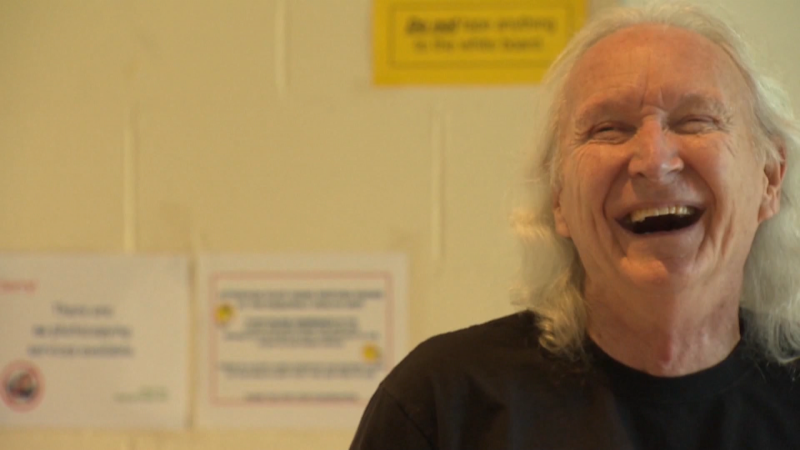

Stew Young claims he was threatened over the tax by an economist working for the province.

Young has said publicly he doesn't like the tax.

He explained on Thursday what he's done to try and get people in Langford exempt from paying it.

Young says he received letters from concerned community members and wanted to put those letters on a council agenda last year so they could be discussed.

When he told this to Rob Gillezeau, a University of Victoria economist working for the province on the tax, Young says he was threatened.

"He said if you put these letters on your council agenda, you will never get out of the spec tax. So I put them on my council agenda after that meeting, because I had to," Young said on CFAX 1070. "And guess what? Langford is not out. So is that not a threat? Is that not how this finance ministry deals with people?"

CTV has confirmed with two other sources that the meeting Young refers to did take place and that they too perceived the exchange as a threat.

CTV also reached out to the premier's office, Gillizeau and the finance ministry for a comment.

A spokesperson for the premier's office says staff have looked into Young's complaint and the exchange Langford's mayor describes did not take place.

The ministry says the regions covered by the speculation and vacancy tax were selected solely because they are the largest urban centres with the most significant housing affordability challenges.

Despite the backlash, the tax is happening.

More than a million homeowners in B.C. will soon get a letter and it could be followed by a big tax bill meant for speculators.

The letters tell homeowners how to opt out of the tax.

Every owner on title in the Capital Regional District and the Nanaimo Regional District has to fill it out.

Only a small fraction of those getting letters actually need to pay the tax.

The speculation tax targets those with more than one home that leave a property empty for most of the year. On a $1-million house, B.C. residents could face a $5,000 bill.