ICBC rebate: B.C. drivers to get another round of cheques for pandemic savings

British Columbia’s auto insurer is issuing a second round of COVID-19 rebate cheques in recognition of lower claims costs due to fewer crashes during the COVID-19 pandemic.

The Insurance Corporation of British Columbia (ICBC) says it will start sending out the new rebates in mid-July, returning approximately $350 million to nearly three million ICBC customers.

The new rebates are estimated to be worth an average of $120 per policyholder, according to a statement released Friday.

In March, the auto insurer began mailing out approximately $600 million in rebate cheques due to the drop in insurance claims during the early months of the COVID-19 pandemic. Many of those rebates, however, were delayed in getting to customers due to a "criminal" cyberattack on the Ontario company ICBC hired to print and distribute the rebate cheques.

“I believe we acted responsibly by separating the rebates into two components,” B.C. Premier John Horgan said at a news conference Friday. “We wanted to make sure that the company was in a position to give those rebates.”

The premier said he believes B.C. drivers “deserve the rebate” and said his government has “turned ICBC into a modern publicly owned and publicly focused corporation to meet the needs of British Columbians.”

With the second round of rebates, the insurer says it will have returned a total of $950 million to B.C. drivers.

“We’ve been clear that any pandemic-related savings against ICBC’s bottom line will benefit customers,” said Mike Farnworth, Minister of Public Safety and Solicitor General, in the statement.

“The good news is that ICBC is in a strong financial position to issue a second COVID-19 rebate to customers, putting more money back in the pockets of B.C. drivers,” Farnworth said.

Most customers who had an active auto insurance policy from Oct. 1 to March 31 will be eligible for the rebate, according to ICBC.

Exceptions to the rebate include customers with short-term, storage or distance-based policies, whose premiums already reflect lower usage. ICBC says the rebate is approximately 11 per cent of the premium customers paid for coverage during this six-month period.

“The past year and a half has been tough on all British Columbians, but they’ve been doing the right thing, including staying closer to home and driving less because of the pandemic,” said ICBC president and CEO Nicolas Jimenez in the statement.

“Due to lower claims, we’re in a position to support our customers and bring them some extra relief, and that’s just what we’re going to do,” Jimenez added.

The insurance corporation says it received about 20 per cent fewer crash claims than expected between Oct. 1 and March 31, but also saw a reduction in premium revenue as customers made changes to their insurance policies, held off on getting new ones or cancelled them.

Rebate amounts will vary between customers, depending on whether they had a vehicle insured for the full six months and how much they paid in premiums during that time. Roughly 70 per cent of customers will get a rebate between $60 and $200, according to ICBC.

Customers who used a credit card to pay their insurance premiums will have their COVID-19 rebate returned to the card they used. Customers who paid by cash, debit or Autoplan payment plan will be mailed a cheque to the latest address on file with ICBC.

CTVNews.ca Top Stories

Poilievre will do 'anything to win,' must condemn Alex Jones endorsement: Trudeau

Prime Minister Justin Trudeau is ramping up his attacks on Conservative Leader Pierre Poilievre as he promotes his government's federal budget.

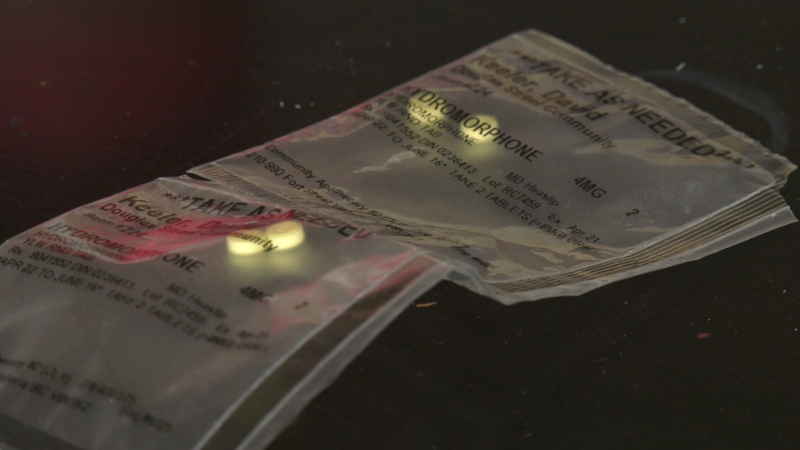

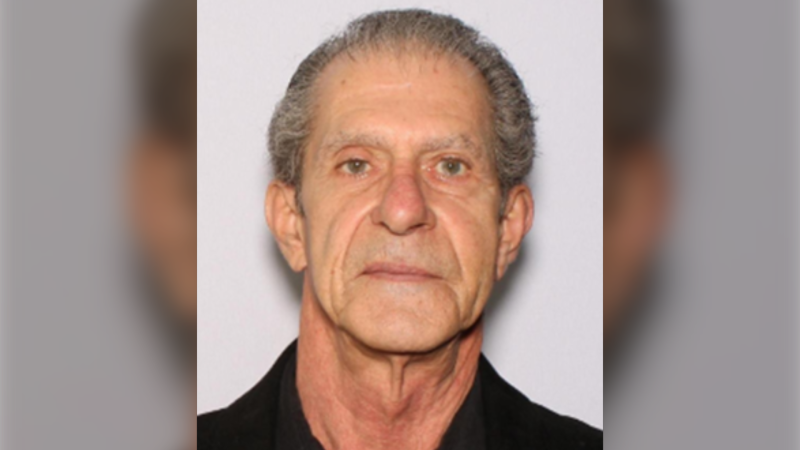

'My stomach dropped': Winnipeg man speaks out after being criminally harassed following single online date

A Winnipeg man said a single date gone wrong led to years of criminal harassment, false arrests, stress and depression.

New evidence challenges the Pentagon's account of a horrific attack as the U.S. withdrew from Afghanistan: CNN exclusive

New video evidence uncovered by CNN significantly undermines two Pentagon investigations into an ISIS-K suicide attack outside Kabul airport, during the American withdrawal from Afghanistan in 2021.

'One of the single most terrifying things ever': Ontario couple among passengers on sinking tour boat in Dominican Republic

A Toronto couple are speaking out about their 'extremely dangerous' experience on board a sinking tour boat in the Dominican Republic last week.

All Alberta wildfires to date in 2024 believed to be human-caused: province

There are 63 wildfires burning in Alberta's forest protection area as of Wednesday morning and seven mutual aid fires, including one in the Municipal District of Peace.

Suspects waving weapons, smashing glass in Toronto jewelry store robbery caught on video

Arrests have been made after five men were captured on video rampaging through a jewelry store in Toronto, waving weapons and smashing glass display cases.

Pilot proposes to flight attendant girlfriend in front of passengers

A Polish pilot proposed to his flight attendant girlfriend during a flight from Warsaw to Krakow, and she said yes.

Ottawa injects another $36M into fund for those seriously injured or killed by vaccines

The federal government has added $36.4 million to a program designed to support people who have been seriously injured or killed by vaccines since the end of 2020.

Ex-SNC executive sentenced to prison term in bridge bribery case

The RCMP says a former SNC-Lavalin executive has been sentenced to three and a half years in prison in connection with a bribery scheme for a bridge repair contract in Montreal.