The cost of insuring strata buildings across B.C. is going up. In some cases, way up.

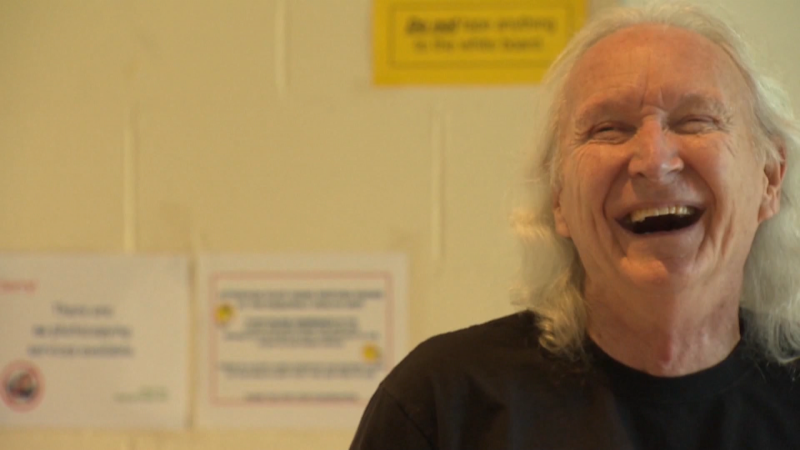

Tony Gioventu, executive director of the Condominium Home Owners Association of B.C, says soaring insurance costs are being seen all over the province, and they're partly caused by high property values and expensive construction costs.

"One of the issues that they're all discovering is that their insurance rates are going from a 50 to a 300 per cent increase, pending their risk," Gioventu says.

Those soaring condo costs have recently been applied to deductibles for claims and to the insurance policies themselves, an expense that gets passed on to the unit owners through their strata dues.

"People are going to see this reflected in their strata fees," Gioventu says. "Expect your strata fees to go up 10 or 20 or more per cent just to be able to cover the additional cost of insurance this year."

The big spike in insurance costs has been seen most commonly for large buildings on the mainland, where the cost of replacing a destroyed building could be as high as $100 million or more.

Gioventu says he's also aware of strata buildings on Vancouver Island also experiencing massive insurance cost increases.

Another factor influencing insurance costs for stratas is the impact of natural disasters, like wildfires.

Susan Bigelowe of Seafirst Insurance Brokers says the cost of insurance for most things has gone up.

"The point of buying insurance means you're spreading the risk over as many people as possible, and that means worldwide," Bigelowe says.

Realtor Charlie DePape says if you're thinking about buying a condo, take insurance seriously.

"It's not just enough to hear your insurance company say, 'Yes we'll give you insurance.' You need to talk about the details of the policy. Let them know what the policy of the strata entails," DePape says.